Treasury structure

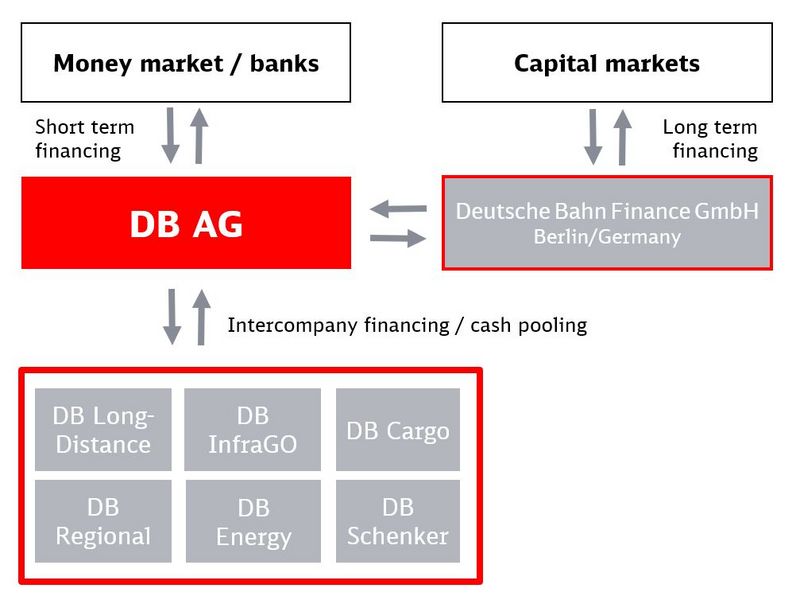

Group Treasury at DB AG is responsible for DB Group financing. This ensures that all Group companies are able to borrow and invest funds at optimal terms and conditions. Before obtaining funds from external sources, we first conduct intra-Group financing transactions. When borrowing external funds, DB AG takes out short-term loans in its own name, whereas long-term capital is generally obtained through the Groupʼs financing company, DB Finance. The funds are passed on to the Group companies within the context of a treasury concept as short-term credit lines, which can be utilized as part of cash pooling on internal current accounts and/or through fixed short-term credit, or in the form of long-term loans. This concept enables us to pool risks and resources for the entire Group, and to consolidate our know-how, realize synergy effects and minimize refinancing costs.

The Treasury operates throughout DB Group as an in-house bank, although it provides a service function rather than acting as a profit center. All Group companies have business relationships with the Treasury. They predominantly involve the borrowing and investment of financial resources and the pooling of liquidity. Treasury transactions are conducted at current market rates, meaning that the agreed interest rates are in line with those quoted by the banks if they were intended to yield a profit.

Market rates also mean that credit margins are adjusted in line with creditworthiness. The credit margin for the infrastructure companies is largely in line with the credit margins of DB AG in the financial and capital market. The credit margins for non-infrastructure companies are higher and are based on an internal metric-based credit rating and the credit margins quoted on the capital market.

Consolidation of the Group finance function in DB AG gives us a uniform market presence in the financial and capital markets, and allows us to achieve economies of scale and cost benefits. In addition, central Group financing enables us to adequately monitor financial transactions and achieve comprehensive risk management.